A game that has emerged within the consumer tech industry is predicting development trends for the next generation of popular products. Will the next Samsung Galaxy have a larger screen? Weigh less? Include marked improvement in camera capabilities? This speculation and more is repeated for any product yet to hit the market, especially successful ones.

It was Apple’s turn to take center stage of new product reveal this week. The company unveiled the iPhone 7 nearly two years to the day that it first presented iPhone 6. Surprisingly, opinions about the new iPhone had more to do with product design than its price (starting at $649 for iPhone 7 and $769 for iPhone 7 Plus). While some design features like the dual camera lenses (one wide-angle and one telephoto) were widely lauded, others were questioned and even ridiculed. The feature ridiculed most was one not included in the design: headphone jacks. No more headphones tethered to a phone. Instead, iPhone 7 features wireless, rechargeable AirPods. One pair is included with the product, and they retail for $169 if bought separately.

Change for Good?

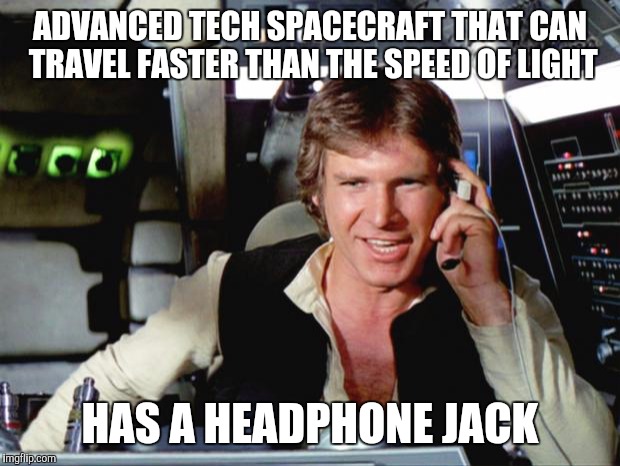

Let’s face it- a smartphone without wired headphones is a feature many of us might struggle to wrap our arms around at first. A user who is shall we say, organizationally challenged, could easily misplace their AirPods. Change sparks uncertainty, fear, and even mockery as evidenced by some of the reaction to iPhone 7 on social media (see a few examples below).

Is elimination of the headphone jack in the iPhone 7 meaningful innovation? Or, is it change for the sake of change? Will the new feature add value to the user experience. Or, is it more of a design feat driven by internal decisions at Apple instead of users’ needs and wants?

Status Quo Resistance

A recent study of US iPhone owners found 51% are interested in upgrading their iPhone to the latest model (although the study was conducted prior to unveiling of iPhone 7). This finding suggests people are open to upgrading if they can be persuaded to make the commitment to the latest iPhone. The decision whether to adopt this product is no different than it is for any other purchase decision. It comes down to a marketer’s ability to shake up the status quo. Will prospective buyers be convinced that upgrading to iPhone 7 will result in a better, more satisfying smartphone experience? If yes, owners could be open to upgrading. If the answer is no or don’t know, the safe course of action is to stand pat and keep their current phone.

The marketing challenge of overcoming status quo resistance reminds me of an often-told story about a family holiday meal. Three generations were gathered in the kitchen preparing the meal. As the mother cuts off the end of a ham before placing it in the pan, her daughter asks why she always cuts off the end of the ham. The mother’s response was “I cut off the end because that’s what my mother always did.” She was in the kitchen, too, so the question was posed why she always cut off the end of the ham. Her response? “I cut off the end of the ham because my mother always cut off the end of the ham.” Fortunately, the family matriarch was also in attendance, so the younger generations asked her the same question. She revealed the secret: “I cut off the end of the ham because my baking pan is too small for the ham to fit.”

What does this story have to do with the Apple iPhone 7 or any other new product? It is reflective of consumer behavior. Many people do what they always do, perhaps even influenced by the behavior of a parent or friend. The behavior becomes rote; we continue it without evaluation of whether it is optimal. Better alternatives could exist, but hey, that would entail change and do we want to deal with the hassle of change?

I recall times when Facebook made significant changes to its user interface. Some of my friends proclaimed “I don’t like the new Facebook, so I’m out of here.” And they were… for a few days. Then, they overcame status quo resistance and adapted to Facebook’s new look. While there is a difference between adapting to a free online service and a smartphone costing hundreds of dollars, the underlying force of resistance is the same.

Time Will Tell

Time (and sales) will tell whether innovations in the latest iPhone resonate with consumers. Some skeptics have been waiting for Apple to fall on its face in the five-plus years since Steve Jobs stepped away from the company. It could happen with the iPhone 7. Or, we could be looking back in a few years laughing at ourselves for the times we walked around with white wires hanging from our ears.